Kam Financial & Realty, Inc. Can Be Fun For Anyone

Kam Financial & Realty, Inc. Can Be Fun For Anyone

Blog Article

Some Known Details About Kam Financial & Realty, Inc.

Table of ContentsKam Financial & Realty, Inc. - TruthsThe Only Guide for Kam Financial & Realty, Inc.Not known Factual Statements About Kam Financial & Realty, Inc. Things about Kam Financial & Realty, Inc.The Definitive Guide for Kam Financial & Realty, Inc.Facts About Kam Financial & Realty, Inc. Revealed

We may obtain a charge if you click a lender or send a kind on our internet site. This fee in no other way affects the information or suggestions we provide. We keep content self-reliance to make certain that the suggestions and insights we supply are unbiased and unbiased. The lending institutions whose prices and other terms appear on this graph are ICBs marketing partners they supply their rate information to our information partner RateUpdatecom Unless readjusted by the customer advertisers are sorted by APR lowest to highest possible For any kind of advertising companions that do not give their rate they are detailed in promotion display units at the end of the graph Marketing partners might not pay to improve the regularity priority or prominence of their display screen The passion rates interest rate and other terms marketed below are quotes supplied by those advertising companions based on the details you entered over and do not bind any kind of lender Regular monthly payment amounts stated do not include quantities for taxes and insurance policy costs The actual settlement obligation will certainly be better if taxes and insurance coverage are included Although our information partner RateUpdatecom accumulates the information from the financial establishments themselves the precision of the data can not be guaranteed Rates may change without notification and can change intraday A few of the info included in the rate tables including however not limited to unique marketing notes is given straight by the lenders Please verify the rates and deals before looking for a lending with the financial organization themselves No rate is binding up until locked by a loan provider.

Kam Financial & Realty, Inc. Things To Know Before You Get This

The quantity of equity you can access with a reverse home loan is identified by the age of the youngest borrower, existing rates of interest, and the value of the home in concern. Please keep in mind that you may need to reserve additional funds from the finance proceeds to pay for taxes and insurance.

Rate of interest may differ and the stated rate might alter or otherwise be readily available at the time of lending dedication. * The funds offered to the consumer might be restricted for the very first year after finance closing, due to HECM reverse mortgage demands (https://kamfnnclr1ty.blog.ss-blog.jp/2024-08-29?1724858623). Additionally, the borrower might require to allot extra funds from the loan continues to spend for taxes and insurance coverage

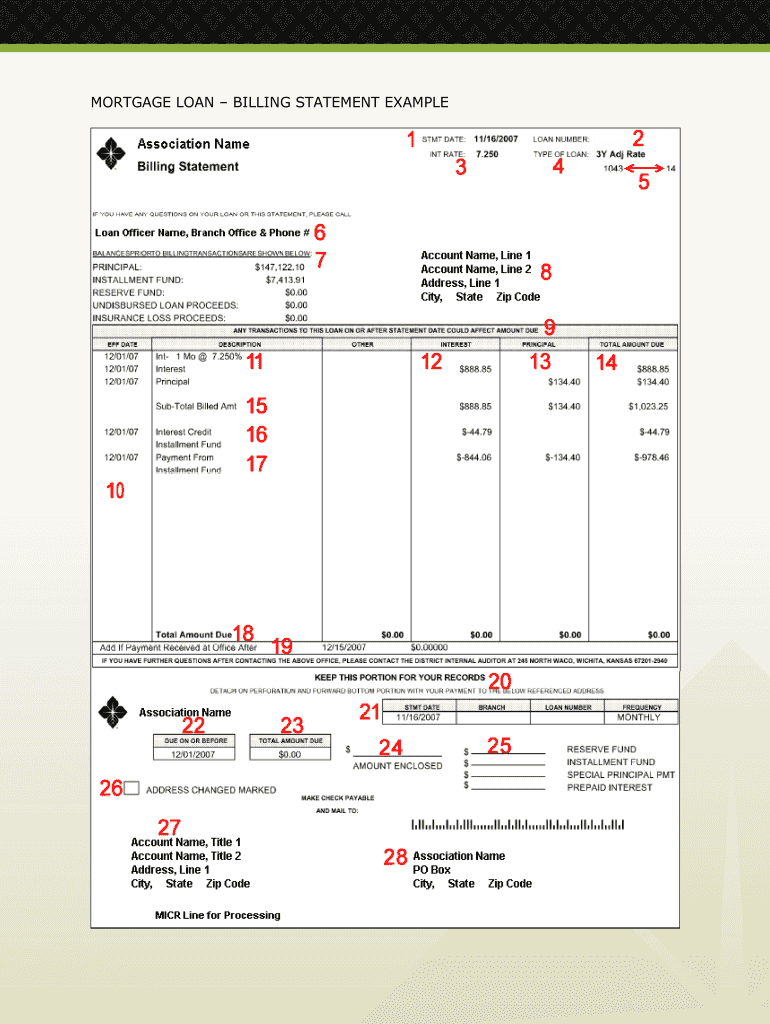

A home mortgage is basically a financial agreement that enables a debtor to purchase a home by obtaining funds from a lending institution, such as a financial institution or banks. In return, the lender puts a realty lien on the home as safety and security for the lending. The mortgage deal usually involves 2 main documents: a promissory note and an action of depend on.

Some Ideas on Kam Financial & Realty, Inc. You Need To Know

A lien is a lawful case or interest that a lender has on a debtor's building as safety and security for a debt. In the context of a home loan, the lien developed by the action of trust fund permits the lender to take possession of the property and sell it if the borrower defaults on the financing.

Listed below, we will take a look at a few of the typical kinds of home loans. These home mortgages include a fixed rates of interest and regular monthly settlement amount, supplying security and predictability for the borrower. For example, John makes a decision to purchase a home that costs $300,000. He safeguards a 30-year fixed-rate home loan with a 4% rate of interest rate.

Indicators on Kam Financial & Realty, Inc. You Need To Know

This implies that for the whole thirty years, John will certainly make the exact same month-to-month payment, which supplies him predictability and stability in his economic planning. These home mortgages start with a set rates of interest and payment quantity for an initial duration, after which the rate of interest and repayments might be periodically adjusted based upon market conditions.

Getting The Kam Financial & Realty, Inc. To Work

These home mortgages have a set rates of interest and payment amount for the funding's duration however need the debtor to pay off the loan balance after a specified period, as established by the lender. mortgage broker california. Tom is interested in buying a $200,000 home. He chooses a 7-year balloon home loan check that with a 3.75% set rates of interest

For the whole 7-year term, Tom's monthly repayments will certainly be based on this fixed passion rate. After 7 years, the staying loan balance will end up being due. Then, Tom must either pay off the outstanding equilibrium in a round figure, refinance the lending, or sell the residential or commercial property to cover the balloon payment.

Incorrectly declaring self-employment or an elevated placement within a business to misrepresent revenue for home loan purposes.

10 Simple Techniques For Kam Financial & Realty, Inc.

Report this page